The purchasing function no longer acts as just a cost center but is one of the most value-enhancing functions in any organization, whether it be in the manufacturing, distribution, service industry or retail sector. The purchasing function plays a vital role in customer satisfaction and total end-to-end supply chain cost, so therefore, it must measure the activities of both its internal activities and its suppliers.

Many procurement metrics are valid for both products and services. Some metrics can be specific to a particular supply chain, such as pharmaceuticals or healthcare, and often using industry-specific measures can be more relevant and beneficial than generic measures. Some of the metrics in the following sections might not be solely-owned by procurement, but they are affected by procurement decisions.

Financial Metrics

Procurement is often responsible for defining and meeting cost-saving goals. The following are some of the metrics used to determine how well the organization is performing in the area of cost reduction, and how purchasing performs its activities against the budget.

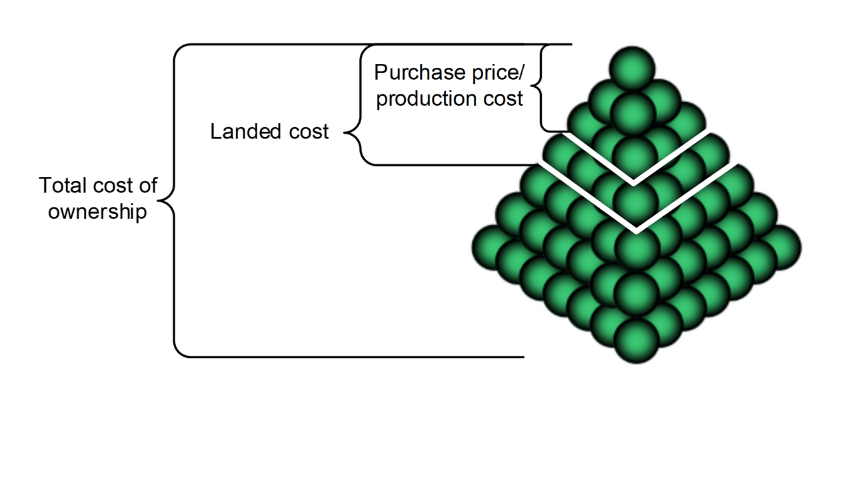

- Total cost of ownership (TCO) is “the sum of all the costs associated with every activity in the supply stream” (APICS Dictionary, 16th edition). This would encompass all costs from the point of origin through any reverse flow activities, such as transit times, tariffs, duties, etc., not just the purchase price. It is often impacted by the geographical locations of supply chain points.

- Price performance compares the actual price paid on a particular purchase order (PO) with other variables such as: ◦ Budgeted price ◦ Published market index pricing ◦ Price between plants, divisions or business units ◦ Current price against a benchmark price

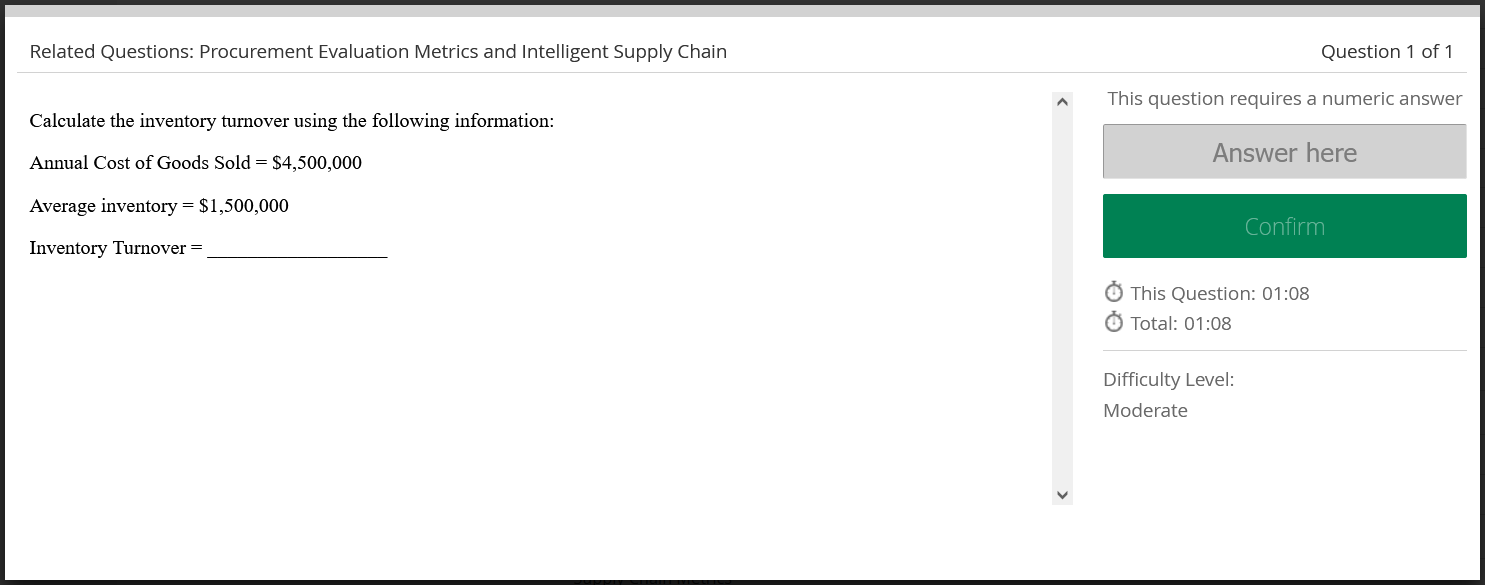

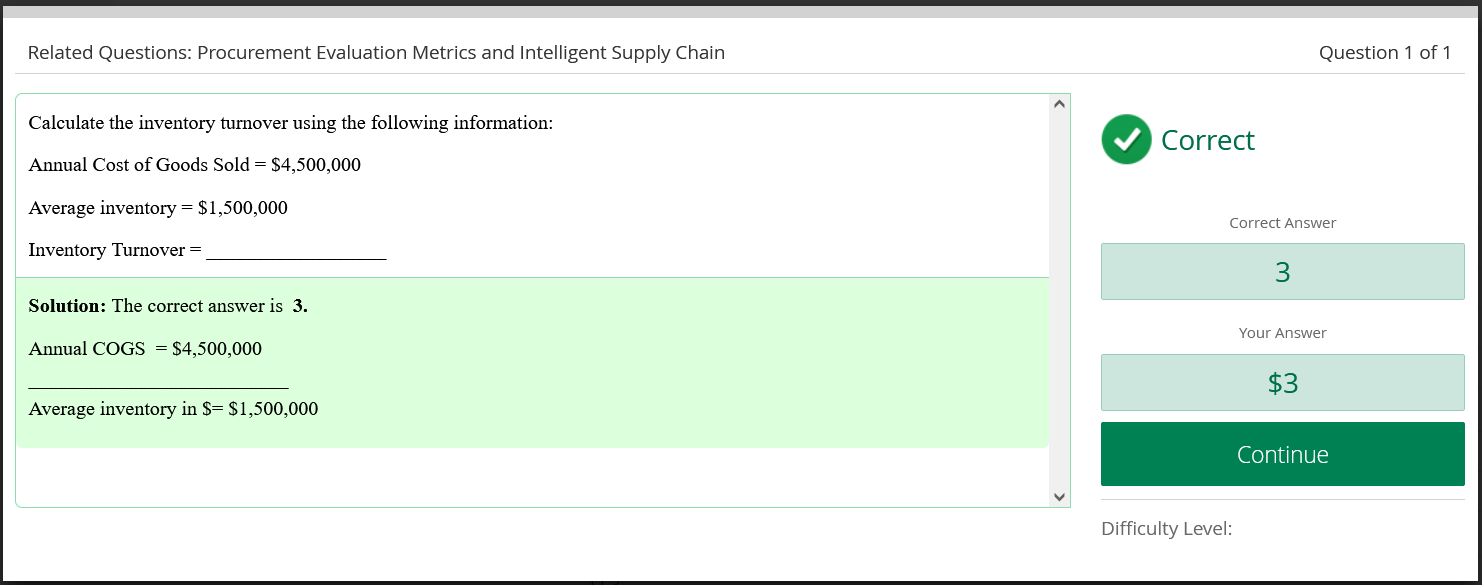

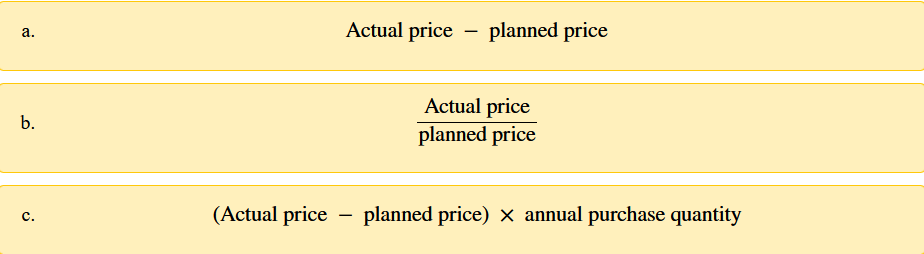

- Purchase price variance (PPV) is the most common price performance measurement and is define as “ the difference in price between the amount paid to the supplier and the planned or standard cost of that item (APICS Dictionary, 16th edition). This can be accomplished by using the following methods:

Traditionally, reducing PPV was motivation for purchasing large quantities in order to receive price discounts, which is not always the best solution as it may drive up inventory carrying costs, and may conflict with other objectives, such as lean principles.

- Cost-effectiveness measures consider procurement activities that result in cost reduction or cost avoidance, such as ◦ Cost changes – compares cost over a period of time to determine increases or decreases (new price – prior price, multiplied by estimated volume) ◦ Cost avoidance – difference between price paid and potentially higher prices, such as prior to negotiations, purchases from other sources, purchase of alternative goods and services ◦ Cost reductions – savings from negotiated contracts, different payment terms, VMI programs

- Revenue and value-add measurements demonstrate the impact of procurement on the firm’s revenue and economic value-added performance. Examples include: ◦ Royalty revenues from new technology developments or patents ◦ Savings due to value of free samples from suppliers ◦ Revenue increase due to supplier-provided technology or customers

The measurement for Economic value added (EVA) is “the net operating profit earned above the cost of capital for a profit center” (APICS Dictionary, 16th edition). For purposes of this course, it recognizes procurement’s contribution towards revenue, operating costs and capital investments.

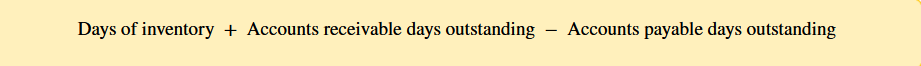

- Asset management measurements indicate how well an organization is managing assets such as cash and inventory. Procurement’s affect on these measurements includes supplier pricing, terms for payment, and decisions made on quantities, all of which influence the calculations.

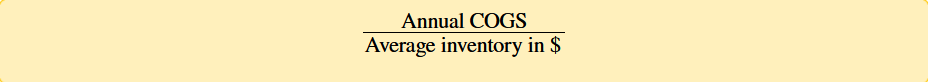

- Inventory turnover is “the number of times that an inventory cycles, or ‘turns over,’ during the year” (APICS Dictionary, 16th edition), using the annual cost of goods sold (COGS) and average inventory.

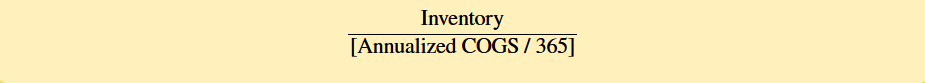

- Days of supply computes the number of calendar days of sales available based on recent activity, in order to determine how long inventory will last. From a financial perspective, it is “the value of all inventory in the supply chain divided by the average daily cost of goods sold rate (APICS Dictionary, 16th edition).

- Administration efficiency measures the planning and control of expenses such as overhead costs, salaries, travel, training, office supplies, etc. Some of the more common for procurement are: ◦ Budgeted vs. actual operating costs ◦ POs and PO lines processed per headcount ◦ Change orders processed ◦ Employee productivity ◦ Average $ cost of PO ◦ Operating costs as % of total dollar volume of purchases ◦ Cash discounts earned and lost